Over the last five or so years almost every new fund manager that Gateway comes across, whether from Australia or from offshore, tell us they have strategically decided to focus marketing efforts on the High Net Worth (HNW) and Family Office sectors of the market. In many instances where products that have small capacity limits, such as niche hedge fund offerings, then it makes sense not to target the institutional market and often the complexity and costs of tackling the retail market are daunting – which leaves the HNW and Family Office segments looking very attractive. However, in our experience the HNW and Family Office market is just as rigorous, sophisticated and compliance focused as all other investor segments, and has as many hurdles. This insight has been written to provide some investigation into why this is the case, and why indeed this segment is not the ‘low hanging fruit’ that many assume them to be.

- 1. A financially astute segment

There are now almost 200,000 Australians with investable funds over $1 million[1] and a large number of advisory firms and specialist Private Banks have set up to service them. The Family Office segment in Australia is growing, and many Family Offices have their own premises with investment staff to advise them. HNW investors and Family Offices have been successful because they have successfully analysed investment opportunities and made money from these. They are usually financially very astute, often entrepreneurial and frequently are in the position where they can make their own decisions. Others though, have grown to the point where they have appointed investment advisers or portfolio managers to manage their assets, or have moved from an individual or Family Office head making decisions to collective decision making. In all instances they are seeking best of breed investment product which can meet their needs for both risk adjusted returns and fees paid.

- 2. Existing investment biases

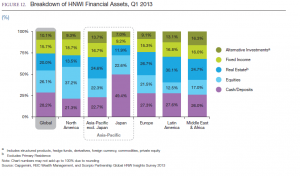

Many HNW individuals and/or families bring substantial individual investment biases to how they want to invest their money, which may be based on a relative lack of sophistication or a great deal of sophistication. Sometimes those biases are to other assets they own – many Family Offices in Australia, for example, have made their money out of property and still have the majority of their assets tied up in that asset class leaving little for investment elsewhere. Fund managers need to be strategic in their targeting of this sector by offering them something they do not already own. The chart below shows globally the asset allocation for HNW investors from the World Wealth Report, 2013.

- 3. Evolved to professional investors

Family investment offices tend to change over time. There tends to be an evolution that occurs within these families as they invest, in that they become more institutional in their approach, adopting more traditional investment management practices in terms of asset allocation and diversification of risks and processes for identifying managers and evaluating those managers. The (Family Office) and HNW investor ends up acting more like a professional investment institution, for which maximizing investment performance is a primary goal.

- 4. Employ advisers

HNW individuals are frequently advised to develop a specific investment strategy through a designated committee that includes outsiders. A robust reporting mechanism is also usually in place, and portfolios are rebalanced periodically to evaluate whether they are reaching their investment goals. Family Offices often use third-party managers and firms to advise them when they need it. Often outside firms have a better bird’s-eye perspective on how other people with similar-size pools of money are investing. Therefore to get your products through to the HNW individual, their advisors or Family Offices you essentially need to be going through the gatekeepers which are their advisers. This is no different to dealing with most sectors of the Australian market.

In addition market conditions have necessitated that even the wealthiest families and individuals take a more critical look at their investment practices. Wealth preservation is demanding increased focus today, however when you add economic uncertainty to the mix as well as the goal to protect wealth and ensure the family legacy endures, it is clear that High Net Worth investors and Family Offices, like any other segment, need to conduct thorough due diligence, research and analysis on potential investment opportunities.

Often the individuals managing investment on behalf of HNW or Family Offices are subject to the same KPI’s as traditional fund managers and need to have evidence to support their investment decisions in terms of research reports or independent corroboration.

- 5. Doing things differently

The World Wealth Report 2013 explores the notion that HNWs and Family Offices are moving to a greater interest in “mission driven investing” which they define as “investing for passion and purpose, not just investment growth.” An example of this is investing in assets they called Investments of Passion for example art. The World Wealth Report states that investment in art has experienced significant growth in recent years. Especially since the financial crisis, art is increasingly becoming a meaningful element of HNWI portfolios. Not only can a well-chosen piece of art act as a hedge against inflation, it has the potential to outperform over the long-term, along with a low correlation with traditional asset classes.

Implications for managers

Developments Gateway has observed in the HNW and Family Office space over the past few years include:

- Appointing independent advisory groups to provide external supporting research/due diligence about the investment opportunities

- Developing specific objective focussed investment approaches

- Benchmarking existing practices among peers

- Building strategic relationships with relevant service providers

- Focus on fees. The old saying, “you get what you pay for” resonates with many wealthy investors. However, in the money management industry it cannot always assumed to be true.

The end result is that these investors are as diligent and focussed on identifying risks and opportunities for excellent investments as any other investor segment – they are not low hanging fruit ripe for picking. Fund managers need to be offering these investors a ‘solution’ rather than a product. This can be done by innovative, best of breed products which are competitively priced and non-correlated to their major asset holdings. A manager’s marketing messages, investment material and pitch must be at industry best standard to demonstrate the above features in order to succeed in this segment just as in any other segment.